Stenhus Fastigheter issues green bonds of SEK 500 million and completes a tender offer of bonds issued by its subsidiary

Stenhus Fastigheter i Norden AB (publ) (“Stenhus Fastigheter”) has successfully issued senior unsecured green bonds in an initial amount of SEK 500 million within a framework of SEK 700 million.

Stenhus Fastigheter intends to apply for admission to trading of the green bonds on the sustainable bond list of Nasdaq Stockholm. In connection with the issue of green bonds, Stenhus Fastigheter has also carried out a tender offer to holders of its subsidiary MaxFastigheter i Sverige AB (publ)’s unsecured bonds 2021/2024.

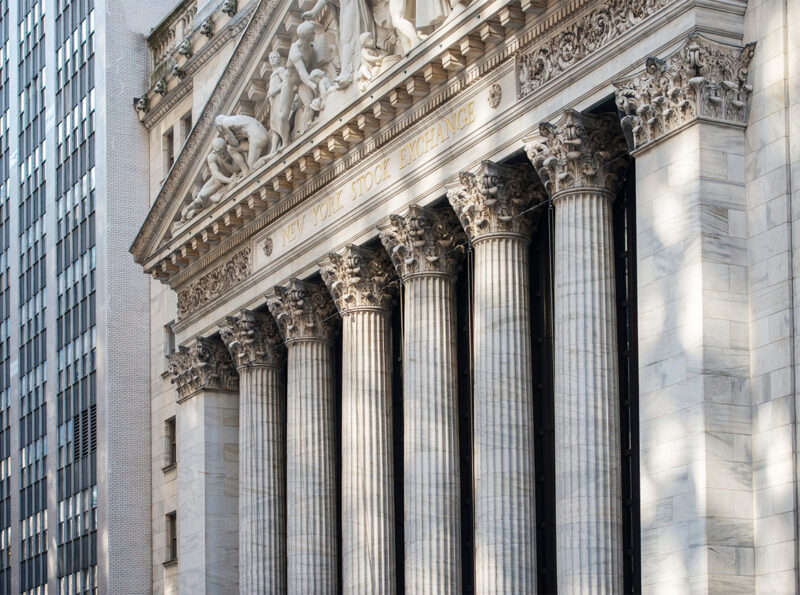

Stenhus Fastigheter is a real estate company that owns and manages public and commercial properties. The company’s primary geographical market is the Stockholm region. Stenhus Fastigheter’s shares are listed on Nasdaq First North Premier Growth Market.

Stenhus Fastigheter was advised by Mannheimer Swartling in the transaction.